Case Study – Telecom Billing

|

COMPANY

INDUSTRY

CHALLENGE

SOLUTION

RESULTS

|

Introduction

This is a case study of a full fledged Telecom Billing System implemented in Australia. This telecom company provides their subscribers with various telecom services, such as mobile services, internet services, fixed line services and voip services. For each type of service, they had 2 or 3 different service providers or carriers who were providing the underlying networks and infrastructure. As such, this Telecom Company can be categorised as an MVNO (Mobile Virtual Network Operator) if you only consider the mobile services.

All services were essentially postpaid services but with prepaid subscriptions. This means that the calling, mobile data usage and all other services were available to use without there being a prepaid limit. The customers paid for their service at the end of the billing period after receiving the invoice that contained their usage charges and plan fees. On the invoice, the plan fee was charged in advance (prepaid) and the usage charges were as per actual usage charged in arrears (postpaid).

Considering the postpaid nature of usage charges, this case study can be termed as a case study of a postpaid billing solution, also an MVNO billing solution and a multi brand billing solution as there were multiple brands under one company.

However, this Multi Brand Telecom Billing implementation that does not use the multi-tenancy feature of the system, but meets multi-brand requirements through a single tenant. If you would like to go through a case study of multi-tenant billing system solution, please refer this Case Study: Multi-brand Call Center.

Data Migration

The client was using an existing billing system and the data was migrated from the old system to jBilling. A simple set of csv file formats were provided from jBilling side for this purpose. The csv files were generated for customers, subscription orders, one time fees, pending balances, historical invoices, historical payments and recurring payment instruments like credit cards and bank accounts. A standard migration utility was used to load the data coming from these csv files into the jBilling system.

Phased Implementation of a Postpaid Billing Solution

The client was using an existing billing system and the data was migrated from the old system to jBilling. A simple set of csv file formats were provided from jBilling side for this purpose. The csv files were generated for customers, subscription orders, one time fees, pending balances, historical invoices, historical payments and recurring payment instruments like credit cards and bank accounts. A standard migration utility was used to load the data coming from these csv files into the jBilling system.

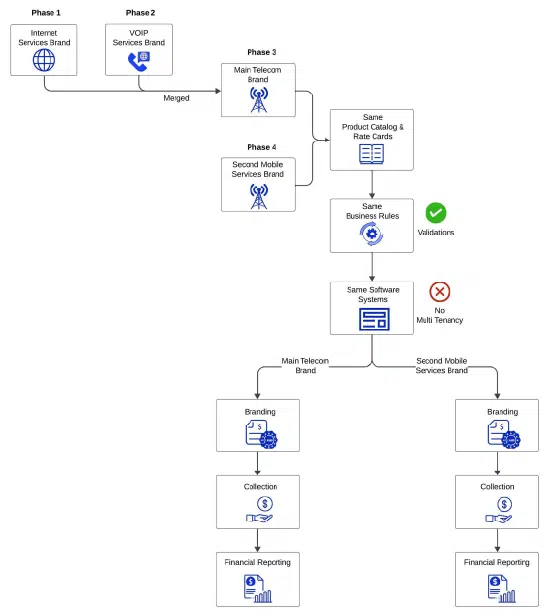

Multi-brand Billing under the umbrella of Same Entity with Same Business Rules

Phase 1 – Internet Services Brand

The project started with one of the sub-brands being made live with subscription billing. This sub brand was offering internet services in Australia. It did not have any consumption usage based billing, only the recurring charges for plan fees. This was an easier brand to make live, with only a couple of customisations. The custom works included the payment gateway integration with an Australian Payment Gateway and a customized invoice design and email design with the company branding.

Phase 2 – Voip Services Brand

The next phase was to make a brand with Voip services live. This project involved data migration, changes to the invoice design and support for each subscription to have multiple voip numbers linked on them. It was also possible to add new Voip numbers to existing subscription by paying for each extra number. The billing involved was recurring billing based on plan fees and some recurring charges for additional voip numbers.

Phase 3 – The main Telecom Brand

This was the main Telco brand and subscribers were mainly using mobile services, fixed line services, voip services and internet services under this brand. This was the biggest brand too and had a bigger number of subscribers. There were different carriers involved that provided the underlying network infrastructure. These services included subscription as well as usage billing.

There were about 5 carriers catering to various services, with 2 key mobile network operators. The carriers and MNOs provided the mediation files to process the usage charges to the end customers. There were about 12 different mediation file formats. This implementation required a complete Billing solution with both prepaid and postpaid subscriptions, charges, discounts and fees involved.

At this juncture, the integration with an in house CRM system was made live. This integration mainly included the customer on-boarding, subscribing to a new service, plan change and adding new payment instruments to name a few. Apart from the integration with CRM, there were also new features required to be developed like providing call credits, data pools and associated notification alerts.

Phase 4 – Launch of a Second Mobile Services Brand

A year after going live with the main Telecom brand, another new mobile services brand was launched – pan-Australia. This project involved new branding of the invoices and notification messages. Also, different payment gateway merchant account to collect payments into and changes to support new mobile plans.

This brand was launched within 2 months of initiating the project and has increased the clients business by about 70% in 2 years.

The uniqueness of this Telecom Billing implementation is that it allowed multiple brands to coexist within the same entity (or company in the billing system). The system had the ability to be customized and implemented in a way that the client could acquire different brands and merge them under one entity. Thus till Phase 3, there were 3 different brands merged into the main company and all 3 were live under the same brand. Then in Phase 4, a new brand was launched using the same entity and without using the multi-tenancy of the system.

Here the requirement was such that from a system point of view, all brands needed to be applied with the same business rules and offer similar plans and rates, but for the outside world and customers they were different brands. The system was customized to support this within the same tenant (or entity) and sent different invoice designs and collected payments to different accounts based on the brand.

Phase 5 – System Improvements and Customisations

This phase of the project involved streamlining certain system aspects, resolve certain pending issues and developing new features. Some key improvements and changes are:

1. Show mobile data usage in real time on mobile app and customer portal,

2. Ad hoc credit notes to be applied with real time effect on the customer balance,

3. Payment Collection to retry payments for overdue invoices two times each month, for a period of 3 months for each overdue invoice,

4. Implementing new file based payment gateway integration,

5. International roaming, and,

6. Operational Automation

Integration with the CRM system

The CRM system was integrated with the jBilling system through a seamless REST API layer. The key use cases implemented through this integration were:

1. Customer On-boarding – CRUD APIs to support Customer management.

2. New Service Sale – The workflow on the CRM side included the activation of the service on the network (through provisioning requests) and a SIM card activation in case of a mobile service.

3. Addition of a New Service to an Existing Customer

4. Cancellation of a Service – Stopping the service on the given date to stop applying any charges from that day onwards.

5. Plan Change – Moving the customer from one plan to another plan seamlessly without any service disruption and prorated charges to keep fair billing.

6. Adding New Recurring Payment Instruments – The payment instruments were tokenized and stored into the billing system for recurring payments. The payment processing confirms to PCI DSS Level 1 compliance standards.

7. Updating/Removing Payment Instruments – Easy maintenance of payment instruments and cleanup of expired cards.

8. Customer Name / Address updates

9. Customer Billing Cycle Change – The subscribers had an option to change the billing cycle with full back end calculations for usage charges, support for quota adjustments and associated usage alerts and prorata charging of subscription fees.

10. Service Transfer – This use case included support for movement of the customer’s plan from an existing fixed line service to a voip service. This support was provided to ensure gradual movement of customers from old technology to new technology networks.

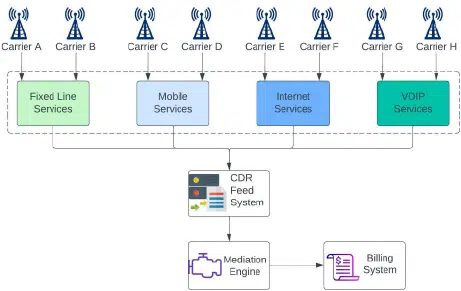

Billing Mediation

The Billing Mediation caters to processing and application of usage charges from the billing system. Read more about Billing Mediation Feature here.

In this Telco implementation, there were about 8 different carriers providing 4 different services and about 12 different CDR file formats. The CDRs stand for the Call Data Records, and these are usage consumption records of a particular service.

The above diagram shows how various services processed the Call Data Records and fed the data to the mediation engine. Their CDRs are received from different sources (or carriers) and fed into the billing mediation system. After that, the CDRs are resolved and converted into chargeable units to be applied to an account and a service. The CDR events are stored into the database. These stored events can be available to be fetched by a mobile app or customer portal to show a subscriber his or her usage.

Each type of telecom service and the CDR file frequencies, volumes and significance as processed in the billing mediation system is explained below:

Mobile Services

There are CDRs provided by two leading Australian mobile service providers. One of the providers sends the CDRs once every hour, totalling about 24 CDR files each day. The CDRs contain usage of different types of calls such as local calls, national calls, international calls, roaming calls, calls from mobile to fixed lines and also the mobile data usage.

One of the mobile carriers provides separate files for sending notification alerts for mobile data usage. These files are received throughout the day with an interval of 10 to 15 mins between files. The mediation job therefore runs 24×7 and keeps processing CDR events for rating as well as for sending notification alerts to subscribers tracking their quota.

Fixed Line Services

The fixed line services are provided by two different carriers. They send CDR files every alternate day. One of the carriers also sends a monthly rental file for charging rental charges for their service. While there are subscription charges for the fixed line plan, these rental charges from the carrier are related to the phone instrument and the additional rental charge. The rental CDR file is processed around 15th of each month and the rental charges are applied as received from the file.

Voip Services

Similar to the fixed line services, the Voip services are provided by two different underlying carriers. The CDR files are sent at an interval of 2 to 3 days.

Internet Services

The files are sent by the underlying carriers every day. Although there are no consumption charges for the internet services, the mediation helps subscribers understand their total usage in gigabytes and the same reflects on their monthly invoice.

Free Usage Quota and Data Boosts for Mobile Data Usage

Every mobile plan has a predefined free quota in gigabytes like 30 GB, 50 GB, 100 GB and so on till 300 GB of free data. By free data, it is meant here that the given quota is included within the plan fees and there are no additional charges for using the mobile data within this limit.

Additionally, when the free quota is exhausted and fully utilized, a set of 3 to 5 data boosts are added dynamically from the plan. Each data boost is about 1 GB or 10 GB of data made available on the fly. When the data boost is added, a fixed fee is charged to the account. It is possible to keep this data boost fee configurable in the system. The number of data boosts available on the plan are also configurable on the plan.

Call Credits or Credit Pools

Another interesting feature of this telecom implementation is the Call Credits or Credit Pools. The Call Credits feature is similar to a free usage quota for mobile data, except that it is defined as an amount pool and not as a free quantity pool. Thus, a plan is promoted as having 100 GB of data free and free local and national calling up to certain dollar amount (for example $20 or $50 etc).

Compliance Requirements

There are certain regulatory compliance requirements in Australia with respect to charging of mobile data usage. The mobile service provider is required to send alerts regarding mobile data usage thresholds such as use of the 50% quota, 85% quota and 100% of the quota. In order to fulfil these compliance requirements, the system was configured for 3 SMS alerts to send usage notification alerts at 50% utilization, 85% utilization and at 100% utilization of the free usage pool.

Further, the 100% utilization also leads to triggering of a data boost to be added to the plan on the fly. This also comes with a fixed fee. The SMS alert at 100% utilization of the free pool mentions that a data boost of 10 GB has been added at a fixed fee. After using each data boost a 100%, another SMS alert is triggered to inform the subscriber that another data boost is being added at a fixed fee. After the last data boost is used 100%, an SMS alert is sent informing the user to upgrade to a higher plan to avoid excess data charges and avoid a bill shock.

Similarly, the notification were setup for Call Credits at 50%, 85% and 100% utilization of Call Credits.

Custom Invoice Formats

As part of the implementation project, 2 different custom invoice formats were designed and developed. This required that branding was provided for invoice PDF templates and the emails that were used to send the e-bills.

The custom invoice formats catered to full extent the branding requirements of the client. The custom invoice design was provided by the client’s team and involved a collaborative effort from business team, sales team, design team and the billing team. The billing implementation team provided its consulting during this process in order to get the design right such that it meets the overall objectives of the client from the branding perspective, at the same time meets various scenarios, yet remains simple for the end customer to understand and finally make a payment!

Automated Collection Cycles

The Collection job was customized to suit the client’s needs to allow taking overdue payments with attempts made on credit cards or bank accounts for a period of 3 months. There were 2 payment attempts (1 week apart) on and after the due date in the first month. Similar 2 attempts in the following 2 months. This ensured that the post paid service to the client continued for a period of 3 months (even in case of overdue invoices or failed payments).

There were a set of email notifications sent to the customer (also known as the dunning notifications). If the payments failed due to any reason such as insufficient funds or block on account, separate emails were sent to the customers informing them of the failing payments.

Sending e-bills and Print Bills

The e-bills were sent from the jBilling system with a formatted email and an attached invoice PDF. Such e-bills were supported for 2 different brands. Depending on which brand the customer belongs to, the system automatically sent the requisite email and PDF template. The jBilling system supported sending thousands of e-bills using a batch job.

The Print Bills job generates a batch PDF file that can contain thousands of invoices in a single batch PDF. This batch PDF was fed to a third party printing agency that printed the batch bills, folded and added these to the envelopes and sent to the customers using physical mail.

The invoice was formatted to meet the envelope dimensions and to show the name / address of the customer in the envelope window. On daily basis, thousands of Print Bills were sent seamlessly to customers. The system ensured through automated verification that the generated bills were accurate.

Providing Complex Financial and Taxation Reports

The jBilling system provided some reporting handoffs which were reports used by the financial team on a daily basis. These reports were:

1. Active Services Report

2. Detailed Billing Report

3. Unearned Unbilled Revenue Report

4. Tax ATO Report

5. GL Summary Report

6. GL Detail Report

This reporting ensured that the financial team was in charge of the latest data in accurate fashion and was always ahead of the curve in terms of meeting the compliance required from the financial audit perspective.

Conclusion

This case study showcases 3 important points:

1. The all round capability of the billing platform,

2. The value that was provided over the course of 4 years to the client,

3. The consulting service provided by the implementation and support team resulted in continuous gains for the business.

It is a case study of a successful Postpaid Billing implementation for a Multi Brand Telecom Company which could sell to different markets with different brands in a vast country, yet apply same business rules on all brands.

The implementation team met many challenges during the course of this implementation and consistently applied the domain and technical expertise to overcome those problems. The result is a stable and highly scalable Telecom Billing solution that can service the client for many years to come.